Businesses in India are required to abide by two significant tax-related compliances: TDS (Tax Deducted at Source) and GST (Goods and Services Tax). Tally is a well-known accounting programme that aids companies in managing their accounts and adhering to tax laws.

This manual intends to offer a detailed process for submitting TDS and GST in Tally. It will go over subjects including setting up TDS and GST ledgers in Tally, entering transactions, checking totals, producing reports, and filing returns.

A lot of business in India are looking for Tally Experts who can help their accounitng and finance teams. You can be the a best fit for them but it requires skills. Learn tally from Best Tally Institute in Delhi. There are few concepts everytone should know, top Tally trainers from Delhi helps with free tutorials for students looking for e-accounting.

The tutorial will give a thorough breakdown of the TDS and GST filing procedures in Tally, making it simpler for businesses to handle their taxes and stay clear of fines.

A Basic Step By Step Tutorial For Setting Up And Filing TDS In Tally

Activating TDS in Tally

- Go to the Gateway of Tally and choose the F11: Features option to activate TDS in Tally Prime.

- Choose F3: Statutory & Taxes on the Features panel, and then check the box next to “Allow Tax Deducted at Source (TDS)” to make it active.

- Save the changes.

Creating TDS Ledgers

- By navigating to the Ledger Creation page and choosing “TDS” as the group, you can create TDS ledgers for various TDS rates.

- By selecting “TDS” as the group on the Ledger Creation page, you may create TDS ledgers for various TDS rates. Configure the TDS rate and choose the proper TDS payment nature. For TDS receivable, you can also make a different ledger.

Creating TDS Deductor and Deductee Masters

- Create TDS deductor and deductee masters.

- Name, address, PAN, TAN, and GSTIN are among the data that must be entered.

Sync TDS Ledgers to Purchase and Expenses Ledgers

- Navigate to the Ledger Creation page for the expense or purchase ledger where TDS is applicable, and choose the TDS ledger prepared in the preceding step as the default TDS ledger.

- Save the changes.

Entering Vouchers

- Create a payment voucher or journal voucher to enter TDS transactions in Tally.

- Input the transaction’s specifics, including the name of the party, the TDS amount, and the TDS rate.

- Be sure to choose the appropriate TDS ledger.

- Based on the TDS rate and the size of the transaction, Tally Prime will automatically determine the TDS amount.

- The TDS amount will be shown in the voucher before you save it.

TDS Reports

- To assist you in managing your TDS payments and filings, Tally Prime offers a variety of TDS reports.

- These reports are accessible by choosing TDS from the Reports menu.

- Tally Prime offers several TDS reports, including TDS Challan, TDS Deduction, TDS Payment, and TDS Receivable.

Generating TDS Return

- You can create TDS returns using Tally Prime in the standard format, such as Form 26Q or Form 27Q.

- Go to the Tally Gateway, choose the TDS menu, and select the option “Form 26Q/27Q” to generate the TDS return. To generate the return, adhere to the directions on the screen.

Filing TDS Returns

- Once the TDS return has been verified, you can submit it online via the TRACES site or Tally directly. T

- The E-File button is located in the top right corner of the screen. Click it to file the TDS return in Tally.

- To file the return, complete the necessary fields and click the File button.

Payment Of TDS

- You must pay the TDS in accordance with the filed return after submitting the TDS return.

- You can utilise a TDS payment challan created by Tally to send the payment to the bank.

A Basic Step-By-Step Tutorial For Setting Up And Filing GST In Tally

Setting Up GST in Tally

- Make sure GST is enabled and set up in your firm before entering a GST transaction in Tally.

- Go to the Tally Gateway, choose F11: Features, and check the box next to “Enable Goods and Services Tax (GST)” to activate GST.

Creating A Ledger for GST

- By choosing “GST” as the group on the Ledger Creation page, you can create a GST ledger.

- Decide on the appropriate GST tax type, such as IGST, CGST, or SGST, then enter the GST rate.

- Save the changes.

Creating Vouchers

- In Tally, create a sales or purchase voucher as usual.

- Input the transaction’s specifics, including the parties involved, the items involved, and the sums.

- Confirm that the transaction is subjected to the appropriate GST rate.

Selecting GST Ledger

- Choose the GST ledger you generated in step 2 as the tax ledger in the sales or purchase voucher.

- Based on the GST rate and the transaction amount, Tally will automatically compute the GST amount.

Ensuring GST Amount

- When saving the voucher, make sure the GST amount estimated by Tally is accurate.

- Before saving the voucher, you can check the GST amount.

Saving The Voucher

- Save the sales or purchase voucher after you have confirmed the GST amount.

- The transaction will be instantly posted by Tally to the proper GST ledgers and a bookkeeping record will be generated.

Filing GST Returns

As well as updating your GSTIN and other pertinent information in your business and party records, ensure that your sales and purchase transactions are documented with the right GST rates.

Generating GST Reports

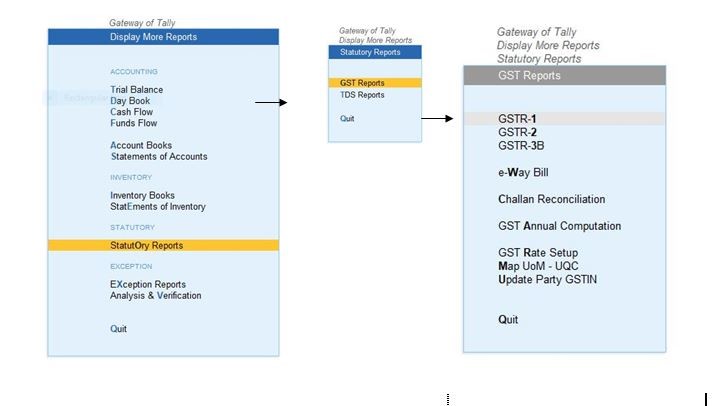

- Go to the Tally Gateway, choose Display from the menu, and then choose Statutory Reports.

- Choose the Tax return you wish to file by selecting GST Reports. Wait for the report to be created after clicking the Generate button.

Preview and Verify GST Returns

Check the report for mistakes or inconsistencies after the GST return is prepared. Fix any problems and check the GST return.

Filing GST Returns

- Using Tally or the GST portal, you can submit the Tax return online after having it verified. Click the E-File button in the top right corner of the page to submit your GST return in Tally.

- To file the return, enter the necessary information and press the File button.

Payment Of GST

- You must pay the GST in accordance with the filed return after submitting the GST return.

- You can utilise the GST payment challan generated by Tally to make the payment via the bank or the GST site.

The Wrap Up

In conclusion, Tally simplifies the TDS and GST filing process by creating the returns in the proper format, checking them, and submitting them online. These methods will help you file your TDS and GST returns quickly and pay your obligations without any fuss.

Learn tally from top E-accounitng institute in Dwarka in Delhi to get equipped with all the skills required to become proficient.