Invoicing is the backbone of any business transaction, ensuring accurate records for payments and taxes. Tally, with its robust invoicing features, simplifies this process for businesses of all sizes. In this guide, we’ll walk you through the updated process of creating invoices in Tally Prime (2025), incorporating the latest GST rules, customization tips, and automation tools. Whether you’re a beginner or an experienced user, this guide will help you make the most of Tally for your invoicing needs.

In this article you will find a very thorough, step-by-step tutorial for creating invoices right here.

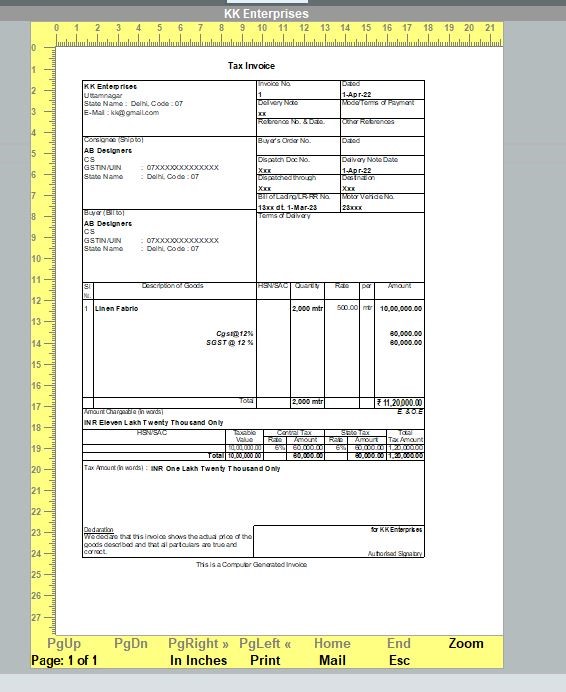

A description of how to see how your invoice will appear in print or as a hard copy may be found towards the end.

What is an Invoice?

An invoice is a written statement that a seller sends to a customer outlining the details of the products or services being purchased, including their costs.

An invoice shows that a buyer owes money to a seller. As a result, a sales invoice is an invoice for the sale of products and/or services from the perspective of the seller. A purchase invoice is an invoice for the cost of products and/or services supplied from the perspective of a buyer.

What is the purpose of invoice?

Every business and professional uses it to keep track of sales and services rendered. Invoices are used by businesses for a variety of purposes, including the following:

- To keep track of sales and supply.

- For tax purposes, keep track of company income.

- It serves as the foundation for urging clients or consumers to make timely payments.

- Invoices may be used to forecast future revenue as historical data.

- To keep track of the company’s inventory.

When it is or should be raised?

In normal commercial jargon, invoices for the provision of products are issued as soon as the commodities are delivered, with a typical credit term of a maximum of 30 days from the invoice date.

In the case of service offering, bills must be issued monthly before the month is over. A 30-day credit term is given from the invoice’s date of receipt once again.

However, the GST law typically governs the timing of tax invoice generation. There are distinct time constraints for issuing invoices for products and services.

How to create a company in Tally?

First and foremost, in order to make our first invoice in Tally, we must first form a firm/company.

So, let’s start with the steps to create a company in tally:

Step 1: If we haven’t created any company yet then just after the tally opens we will be getting the options to ‘create company’, press ENTER.

Step 2: Fill essentials for the company and Click yes and save it

Step 3: It will immediately display a configuration pop up. Allow yourself to add whatever you wish. However, allow GST for all GST-related transactions.

Step 4: Save it either by clicking save in files or by shortcut Ctrl+A. And we have created our company.

How to create an Invoice in Tally?

So, now that we have a well-formed company, we can proceed to generate our first invoice. Let’s Go…

There are two approaches to accomplish the transition.

- The first is to create the invoice basics before adding the voucher.

- Alternatively, you may create the basics and voucher at the same time.

Let’s discuss the first one:

Step 1: Gateway Of Tally (GOT)<Masters<Create.

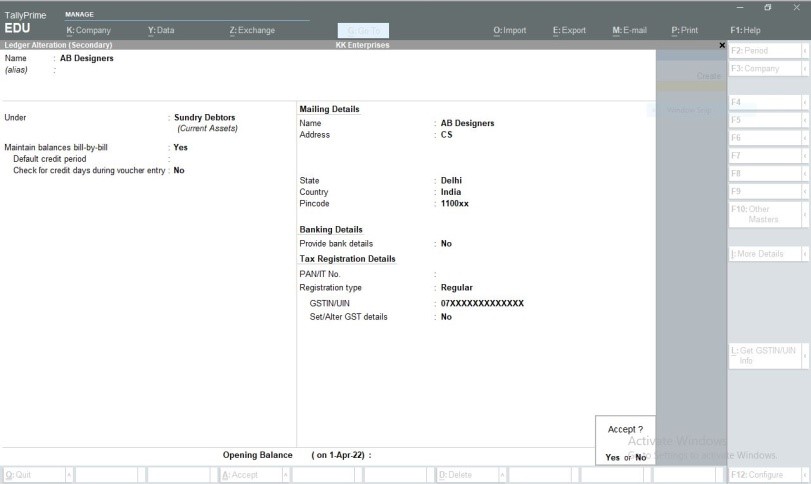

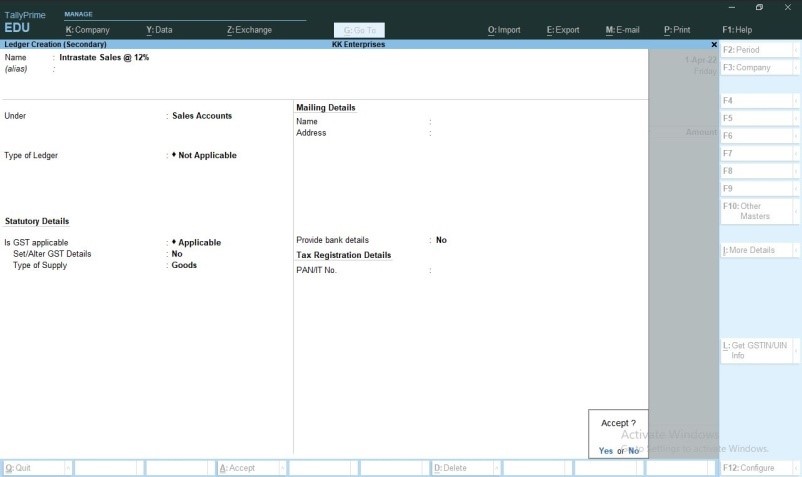

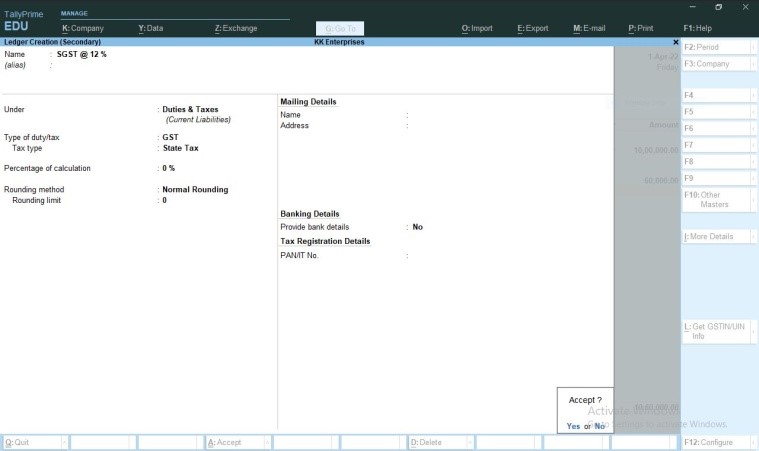

Step 2: Create ledgers of purchasing Party, Taxes(cgst,sgst or igst) and sales and stock item for a basic entry.

*We can add more details as well and create for them also if needed.

Save all the Ledgers by CTRL+A

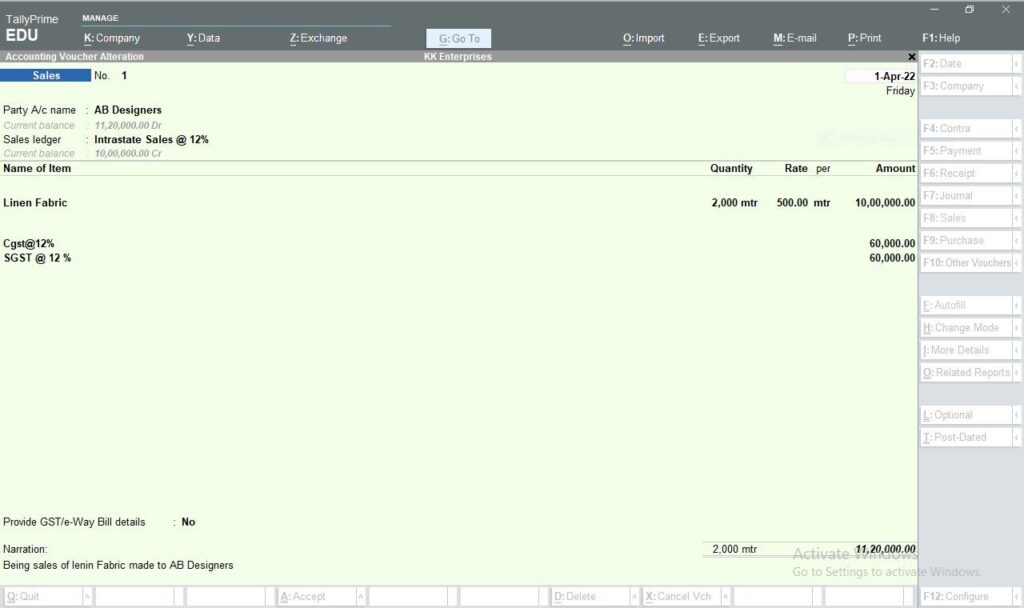

Step 3: Go back to GOT< Transactions<Vouchers

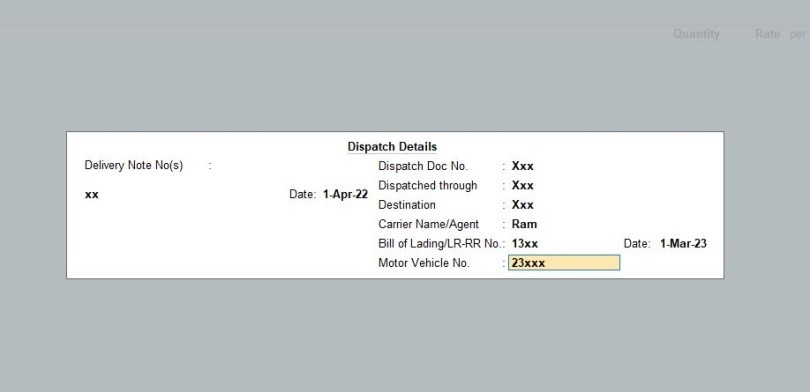

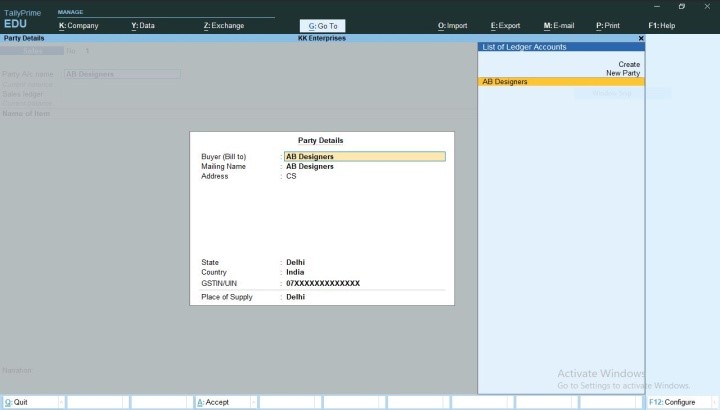

Step 4: Enter the Voucher No.< Party Name< Voucher Type and other credentials.

When we will enter Party name , it will ask us for Dispatch details and Party details we can even disable them in configuration in the beginning or later.

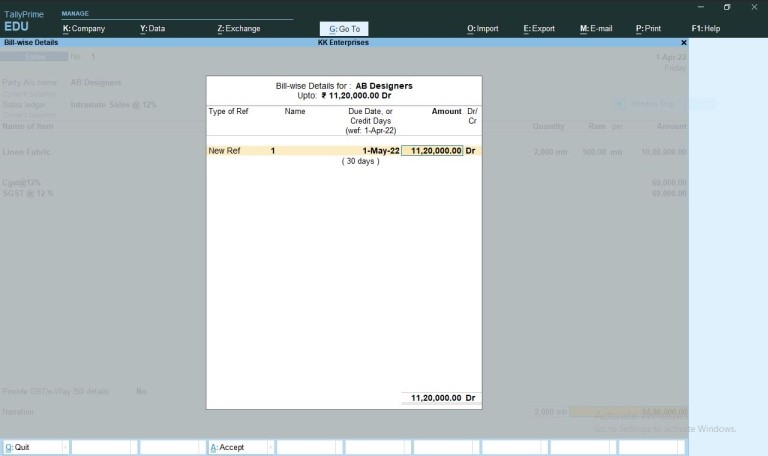

At the end just before coming to narration we will be asked for Bill Wise details.

Step 5: Fill the narration and Save the Voucher.

In the alternative method, we just have to follow these steps:

Step1: Go to GOT<Transactions<Vouchers

Step2: Fill Voucher No. and the remaining credentials by generating them on the fly by pressing ALT+C and filling the credentials.

Then SAVE THE VOUCHER. Also learn, GST & TDS in Tally

Latest features of Tally

Tally Prime, the latest version of Tally, introduces new features to make invoicing even simpler and more efficient:

- E-Invoicing Support: Directly generate and upload GST e-invoices compliant with government norms.

- Advanced GST Reports: Easily track input tax credit (ITC) and generate GST-compliant invoices.

- Customization Options: Add company logos, terms and conditions, and custom fields to invoices.

- Mobile Access: Access invoices on the go using Tally’s mobile app.

- Multi-Currency Support: Create invoices in foreign currencies for international transactions.

How do I print or preview the invoice?

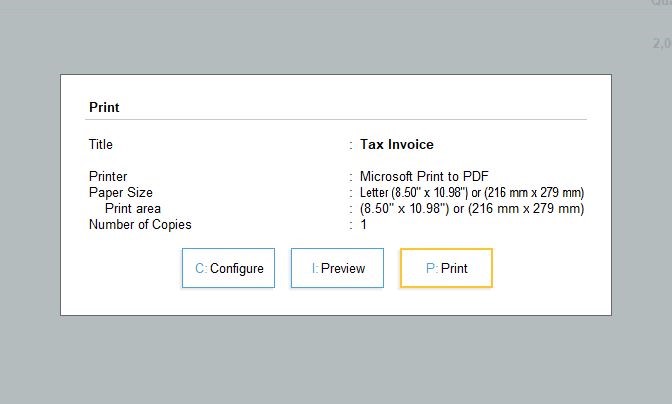

To get the print of the voucher / invoice made, we just have to press ALT+P.

A pop up will be shown where to see the preview just press ‘I’ and to make out the print press ‘P’.

Error Handling in Tally invoice

Even experienced users can make mistakes while creating invoices. Here’s how to avoid or fix common issues:

- Incorrect GST Rates: Always verify GST rates before finalizing invoices.

- Wrong Ledger Mapping: Ensure all items and accounts are mapped to the correct GST and sales ledgers.

- Invoice Not Printing Properly: Recheck printer settings and ensure templates are updated.

Hopefully, I have outlined every single thing in this blog post step-by-step. Tally is a crucial piece of software to learn these days, especially if you’re a student of business or have an interest in the corporate sector. So go ahead and improve your abilities with us.

You can also learn everything about tally from our online Tally crash course at Rs. 1 only. We also have a complete tally course offered offline in Delhi at our institute.